What Does A Hammer Mean In Stocks . This pattern typically appears when a. A hammer candlestick pattern forming at the bottom of the downtrend means trend reversal to the uptrend. It resembles a candlestick with a small body and a long lower wick. In the stock market, the hammer candlestick can indicate significant turning points in stock prices. Economists and traders analyze hammer candlestick patterns to understand price action and selling pressure in stock trading,. It's particularly useful in volatile markets where rapid price swings can often. The hammer candlestick pattern is a popular trading strategy in the stock market, where traders go long when a bullish hammer. A hammer candlestick is a term used in technical analysis. The hammer candlestick formation is viewed as a bullish reversal candlestick pattern that mainly occurs at the bottom of.

from www.elearnmarkets.com

In the stock market, the hammer candlestick can indicate significant turning points in stock prices. It resembles a candlestick with a small body and a long lower wick. It's particularly useful in volatile markets where rapid price swings can often. This pattern typically appears when a. A hammer candlestick is a term used in technical analysis. The hammer candlestick formation is viewed as a bullish reversal candlestick pattern that mainly occurs at the bottom of. The hammer candlestick pattern is a popular trading strategy in the stock market, where traders go long when a bullish hammer. Economists and traders analyze hammer candlestick patterns to understand price action and selling pressure in stock trading,. A hammer candlestick pattern forming at the bottom of the downtrend means trend reversal to the uptrend.

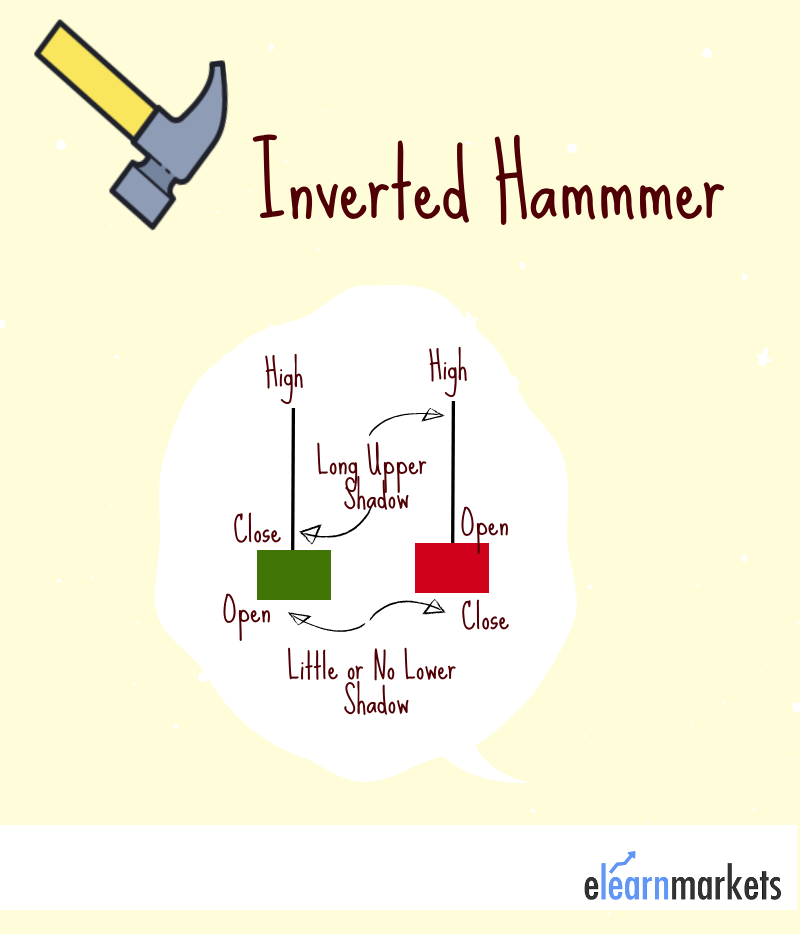

How to Trade With Inverted Hammer Candlestick Pattern ELM

What Does A Hammer Mean In Stocks A hammer candlestick pattern forming at the bottom of the downtrend means trend reversal to the uptrend. A hammer candlestick is a term used in technical analysis. The hammer candlestick pattern is a popular trading strategy in the stock market, where traders go long when a bullish hammer. In the stock market, the hammer candlestick can indicate significant turning points in stock prices. It's particularly useful in volatile markets where rapid price swings can often. This pattern typically appears when a. Economists and traders analyze hammer candlestick patterns to understand price action and selling pressure in stock trading,. The hammer candlestick formation is viewed as a bullish reversal candlestick pattern that mainly occurs at the bottom of. It resembles a candlestick with a small body and a long lower wick. A hammer candlestick pattern forming at the bottom of the downtrend means trend reversal to the uptrend.

From www.forexbloging.com

Mastering the Hammer Candlestick Pattern A StepbyStep Guide to What Does A Hammer Mean In Stocks Economists and traders analyze hammer candlestick patterns to understand price action and selling pressure in stock trading,. It resembles a candlestick with a small body and a long lower wick. It's particularly useful in volatile markets where rapid price swings can often. A hammer candlestick pattern forming at the bottom of the downtrend means trend reversal to the uptrend. In. What Does A Hammer Mean In Stocks.

From forexboat.com

Inverted Hammer Candlestick How to Trade it ForexBoat Trading What Does A Hammer Mean In Stocks The hammer candlestick pattern is a popular trading strategy in the stock market, where traders go long when a bullish hammer. It resembles a candlestick with a small body and a long lower wick. It's particularly useful in volatile markets where rapid price swings can often. A hammer candlestick pattern forming at the bottom of the downtrend means trend reversal. What Does A Hammer Mean In Stocks.

From bloghowtotrade.blogspot.com

How To Trade Blog What Is Hammer Candlestick? 2 Ways To Trade What Does A Hammer Mean In Stocks The hammer candlestick formation is viewed as a bullish reversal candlestick pattern that mainly occurs at the bottom of. It resembles a candlestick with a small body and a long lower wick. Economists and traders analyze hammer candlestick patterns to understand price action and selling pressure in stock trading,. A hammer candlestick is a term used in technical analysis. It's. What Does A Hammer Mean In Stocks.

From forextraininggroup.com

Popular Short Term Trading Strategies Used By Forex Traders Forex What Does A Hammer Mean In Stocks It resembles a candlestick with a small body and a long lower wick. A hammer candlestick pattern forming at the bottom of the downtrend means trend reversal to the uptrend. Economists and traders analyze hammer candlestick patterns to understand price action and selling pressure in stock trading,. A hammer candlestick is a term used in technical analysis. This pattern typically. What Does A Hammer Mean In Stocks.

From www.strike.money

Inverted Hammer Candlestick Pattern Definition, Structure, Trading What Does A Hammer Mean In Stocks It's particularly useful in volatile markets where rapid price swings can often. In the stock market, the hammer candlestick can indicate significant turning points in stock prices. Economists and traders analyze hammer candlestick patterns to understand price action and selling pressure in stock trading,. A hammer candlestick pattern forming at the bottom of the downtrend means trend reversal to the. What Does A Hammer Mean In Stocks.

From trieuson5.edu.vn

Tổng hợp 65+ về mô hình búa ngược hay nhất trieuson5 What Does A Hammer Mean In Stocks Economists and traders analyze hammer candlestick patterns to understand price action and selling pressure in stock trading,. A hammer candlestick pattern forming at the bottom of the downtrend means trend reversal to the uptrend. The hammer candlestick pattern is a popular trading strategy in the stock market, where traders go long when a bullish hammer. The hammer candlestick formation is. What Does A Hammer Mean In Stocks.

From srading.com

Hammer Candlestick Patterns (Types, Strategies & Examples) What Does A Hammer Mean In Stocks The hammer candlestick formation is viewed as a bullish reversal candlestick pattern that mainly occurs at the bottom of. It's particularly useful in volatile markets where rapid price swings can often. The hammer candlestick pattern is a popular trading strategy in the stock market, where traders go long when a bullish hammer. A hammer candlestick pattern forming at the bottom. What Does A Hammer Mean In Stocks.

From realmoney.thestreet.com

If I Had a Hammer Formation, What Does It Mean for Stocks? RealMoney What Does A Hammer Mean In Stocks It's particularly useful in volatile markets where rapid price swings can often. This pattern typically appears when a. A hammer candlestick is a term used in technical analysis. In the stock market, the hammer candlestick can indicate significant turning points in stock prices. A hammer candlestick pattern forming at the bottom of the downtrend means trend reversal to the uptrend.. What Does A Hammer Mean In Stocks.

From www.vectorstock.com

Two crossed hammers isolated on white background Vector Image What Does A Hammer Mean In Stocks Economists and traders analyze hammer candlestick patterns to understand price action and selling pressure in stock trading,. This pattern typically appears when a. The hammer candlestick formation is viewed as a bullish reversal candlestick pattern that mainly occurs at the bottom of. It resembles a candlestick with a small body and a long lower wick. A hammer candlestick is a. What Does A Hammer Mean In Stocks.

From valueofstocks.com

Bullish Reversal 13 Patterns To Identify a Bullish Move Value of Stocks What Does A Hammer Mean In Stocks Economists and traders analyze hammer candlestick patterns to understand price action and selling pressure in stock trading,. This pattern typically appears when a. It's particularly useful in volatile markets where rapid price swings can often. The hammer candlestick pattern is a popular trading strategy in the stock market, where traders go long when a bullish hammer. The hammer candlestick formation. What Does A Hammer Mean In Stocks.

From www.forexschoolonline.com

Inverted Hammer Candlestick Pattern Quick Trading Guide What Does A Hammer Mean In Stocks It's particularly useful in volatile markets where rapid price swings can often. In the stock market, the hammer candlestick can indicate significant turning points in stock prices. It resembles a candlestick with a small body and a long lower wick. The hammer candlestick pattern is a popular trading strategy in the stock market, where traders go long when a bullish. What Does A Hammer Mean In Stocks.

From www.vlr.eng.br

Hammer Candlestick Meaning, Types, Examples, Interpretation vlr.eng.br What Does A Hammer Mean In Stocks This pattern typically appears when a. It's particularly useful in volatile markets where rapid price swings can often. A hammer candlestick pattern forming at the bottom of the downtrend means trend reversal to the uptrend. A hammer candlestick is a term used in technical analysis. It resembles a candlestick with a small body and a long lower wick. The hammer. What Does A Hammer Mean In Stocks.

From nfljerseysfans.com

How to Read the Inverted Hammer Candlestick Pattern? (2022) What Does A Hammer Mean In Stocks The hammer candlestick formation is viewed as a bullish reversal candlestick pattern that mainly occurs at the bottom of. The hammer candlestick pattern is a popular trading strategy in the stock market, where traders go long when a bullish hammer. It resembles a candlestick with a small body and a long lower wick. This pattern typically appears when a. A. What Does A Hammer Mean In Stocks.

From bloghowtotrade.blogspot.com

How To Trade Blog What Is Hammer Candlestick? 2 Ways To Trade What Does A Hammer Mean In Stocks Economists and traders analyze hammer candlestick patterns to understand price action and selling pressure in stock trading,. It's particularly useful in volatile markets where rapid price swings can often. In the stock market, the hammer candlestick can indicate significant turning points in stock prices. A hammer candlestick is a term used in technical analysis. A hammer candlestick pattern forming at. What Does A Hammer Mean In Stocks.

From in.pinterest.com

Hammer Candlestick Pattern Trading Guide Candlestick patterns, Stock What Does A Hammer Mean In Stocks It resembles a candlestick with a small body and a long lower wick. Economists and traders analyze hammer candlestick patterns to understand price action and selling pressure in stock trading,. This pattern typically appears when a. The hammer candlestick formation is viewed as a bullish reversal candlestick pattern that mainly occurs at the bottom of. It's particularly useful in volatile. What Does A Hammer Mean In Stocks.

From www.myxxgirl.com

Best Hammer Candlestick Chart Pattern Images Candlestick Chart My XXX What Does A Hammer Mean In Stocks This pattern typically appears when a. In the stock market, the hammer candlestick can indicate significant turning points in stock prices. A hammer candlestick pattern forming at the bottom of the downtrend means trend reversal to the uptrend. The hammer candlestick pattern is a popular trading strategy in the stock market, where traders go long when a bullish hammer. It's. What Does A Hammer Mean In Stocks.

From www.elearnmarkets.com

How to Trade With Inverted Hammer Candlestick Pattern ELM What Does A Hammer Mean In Stocks It's particularly useful in volatile markets where rapid price swings can often. Economists and traders analyze hammer candlestick patterns to understand price action and selling pressure in stock trading,. It resembles a candlestick with a small body and a long lower wick. A hammer candlestick is a term used in technical analysis. The hammer candlestick formation is viewed as a. What Does A Hammer Mean In Stocks.

From ar.taphoamini.com

What Does Hammer Mean In Ultimate Frisbee? The 8 Latest Answer Ar What Does A Hammer Mean In Stocks It resembles a candlestick with a small body and a long lower wick. It's particularly useful in volatile markets where rapid price swings can often. Economists and traders analyze hammer candlestick patterns to understand price action and selling pressure in stock trading,. A hammer candlestick is a term used in technical analysis. A hammer candlestick pattern forming at the bottom. What Does A Hammer Mean In Stocks.